Governance news bites – February 2025

A collection of governance-related news snapshots that you might have missed in the past two weeks.

(Bloomberg) – All-male boards have quietly returned to Australia’s benchmark stock index.

Four mining firms recently added to the S&P/ASX 200 have zero women on their boards, data from Bloomberg and the Australian Council of Superannuation Investors show. That’s a setback for the index, which only last year reached a milestone of having no firms without female board members.

Capricorn Metals Ltd., Core Lithium Ltd. and Sayona Mining Ltd. have no woman directors, and all of their senior executives are men as well, according to their websites. The lone female director at De Grey Mining Ltd. resigned last month; there are two women on its executive team of 10.

“Once again, there are zero-women boards among the country’s largest listed companies,” said Louise Davidson, chief executive officer of ACSI, which engages with firms on behalf of pension funds. “Those companies promoted into the ASX 200 have a year’s grace before we apply our ‘vote against’ policy to them, but we will be engaging strongly with them in the meantime.”

The bulk of ASX 200 boards with the least women are in the mining industry, which faces increasing pressure from investors to act on environmental, social and governance issues ranging from fossil fuels to its treatment of women. An inquiry this year uncovered dozens of cases of sexual harassment and abuse of female workers at listed firms including BHP Group and Rio Tinto Group.

In a statement on its website, Capricorn Metals says its board “is committed to workplace diversity, with a particular focus on supporting the representation of women at the senior level of the company and on the board.” The company, along with Core Lithium and Sayona Mining, didn’t reply to requests for comment.

De Grey Mining’s last female board member Samantha Hogg resigned last month. A statement at the time said the board was “conscious of its diversity requirements” under corporate governance requirements in its search for a replacement.

Australian pension funds, which are publicly championing ESG issues as their members become increasingly choosy about where their retirement savings are invested, are among some of the biggest shareholders in mining firms including those with all-male boards.

Host-Plus Pty, which oversees about A$89 billion ($57 billion) of assets, voted against both the election of a male candidate seeking a board role at Capricorn Metals and the re-election of a male board member at De Grey Mining due to gender diversity concerns, it said in an e-mailed statement.

REST Super, a A$65 billion fund that’s also a Capricorn Metals investor, said: “We are an active owner and believe that engaging with companies as a shareholder on ESG risks, including appropriate gender representation on boards, is an effective way of protecting members’ interests.”

Aware Super Pty, with about A$150 billion of assets, voted against the re-election of directors “at a number of companies including Core Lithium” in the past financial year on diversity concerns, a spokesperson said in an e-mailed statement.

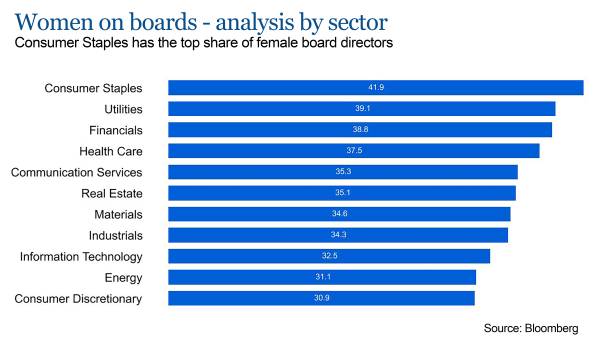

Women are underrepresented in key decision-making roles across almost the entire workforce, according to Australia’s Workplace Gender Equality Agency. While they made up half of all employees last year, they comprise only 19.4% of CEO roles and a third of key management positions. When it comes to boards, 33% include women and only 18% of chairs are female.

“The fact is that diversity brings material benefit to governance outcomes and strengthens decision-making,” said Davidson. “It helps prevent ‘group think’ and promotes better performance over the long-term.”

Women held 11 more seats on company boards in the third quarter of this year, compared with the previous three-month period, according to Bloomberg data. The average number of female directors rose from 2.6 to 2.7. The average size of a board was 7.5 people.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

The views expressed in this article do not reflect the position of the IoD unless explicitly stated.