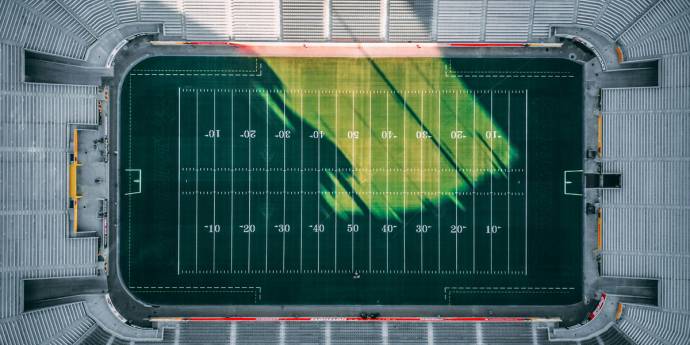

How to win the (board) game

Independent non-executive director Pip Greenwood MInstD says a board must be able to play offence and defence at a consistently high standard to bring value to their organisation.

To achieve that gold-medal standard, she says a range of skills is needed at the board table – both hard and soft – along with institutional knowledge, specialist skills and experience across a range of industries.

Pip Greenwood

“The board adds value by setting strategic direction, ensuring good governance, managing the risks associated with the particular company and supporting the CEO and management team,” says Greenwood, the chair of Westpac and The a2 Milk Company. “The bottom line is the ultimate measure of the value the board is adding.”

To be able to achieve this, she says it is critical the board has the right skills mix. “Industry experience on the board is non-negotiable and so are experienced and seasoned directors who have experience across industries.

“When looking for subject matter experts it is important they can make a broader contribution, otherwise the load of the board does not become evenly spread and puts performance at risk.”

She stresses the need to have a combination of skills, saying: “There is a lot of focus on hard skills, completing the skills matrix, but it is important to have a combination of hard skills and soft skills.

“You cannot have people sitting around the table that can only contribute on one topic which may not come up at every meeting. That may be an extreme example, but it is important to think about broader contribution.

“Diversity is important, both in experience and in the way directors might think about an issue. This avoids groupthink, which can be a risk. You must be able to have healthy debate with your fellow board members.”

While value can be hard to measure or quantify, Greenwood says you know it when you see it – or feel it – and when everyone is bringing their A game.

“You know when you are in sync with your management team. You know when it is good and when the conversations are of a high quality. It is like any environment or culture – when it’s going well, you can feel it and everyone is contributing.”

Conversely, when there is tension, disconnect or distrust, you can feel that too, she says.

“These are fundamental basic human characteristics. There is a lot of EQ required to be a good director. It is not just about IQ. I feel strongly about that. Governance is a completely different skill set to the previous roles directors have had.”

“You know it is not adversarial, but you must be able to spot any issues. Some directors can go off on tangents and waste a lot of time on things that are not relevant or going to make the boat go faster. That said, there are compliance issues and non-negotiables you must deal with.”

One of the most important values a board can bring is making sure you have the right CEO, she says, and the chair’s role is to be a mentor and coach to the CEO. It is important to remember that the chair is not the CEO.

In a recent board effectiveness review, she says a manager made a comment about the board showing empathy and there was a good balance between support and challenge.

The manager also said: “While they do not shy away from asking hard questions, you do feel they have got your back. You don’t feel sick when you walk into the boardroom, but you don’t feel too comfortable either.”

Isn’t that the way you want to be?” Greenwood asks. “A healthy degree of respect. You are all part of the same team going in the same direction – it is not an individual sport. You are in a partnership with management, but you also have your own role to play.

“You know it is not adversarial, but you must be able to spot any issues. Some directors can go off on tangents and waste a lot of time on things that are not relevant or going to make the boat go faster. That said, there are compliance issues and non-negotiables you must deal with.”

The board and chair need to focus on the right things and Greenwood says she spends a lot of time making sure there is the right level of information and detail in the board papers – “you’re adding value by making sure you are focusing on the right things.”

Understanding the organisation and fitting the culture is important, she says, as is the ability to be able to bring experience across different industries. “If you are a square peg around the board table, it can be very divisive for the whole group.”

THE OFFENCE

-

- Strategic oversight: The board helps management to set the long-term strategic objectives for the business. It then monitors the company’s performance against that strategy and adjusts the strategy if, for example, market conditions change.

- CEO recruitment and support: Providing support and guidance to the CEO is really the role of the board. The chair is not the CEO and their role is to mentor and coach the CEO.

- Management support: Directors can bring a wealth of expertise from their fields. That can be of enormous value to the broader management team, providing support and guidance, particularly outside the boardroom.

- Succession planning: This is an important role of the board, both for the CEO and other senior managers, bearing in mind those senior managers are likely candidates for CEO succession so having a pipeline of talent coming through a company is critical. Research has evidenced that an internally appointed CEO is twice as likely to succeed in their role as an external candidate. This underlies the importance of having internal candidates for the role. That is not to say there may be times when a company requires a shift in focus that an external candidate may be able to bring.

THE DEFENCE

-

- Risk management: The board plays a key role in understanding the company’s risks, setting its risk appetite, monitoring against that risk appetite and ensuring the company has appropriate controls in place to ensure it continues to operate within its risk appetite. Risk is a part of doing business and it is important both the board and management are clear on risk management that is appropriate for the type of business it operates.

- Monitoring performance: This includes approving budgets, monitoring financial performance and ensuring the company has the right resources to achieve its goals.

- Governance and compliance: The board is responsible for ensuring a company complies with its legal and regulatory obligations – for example, monitoring health and safety and making sure there are the appropriate processes in place.